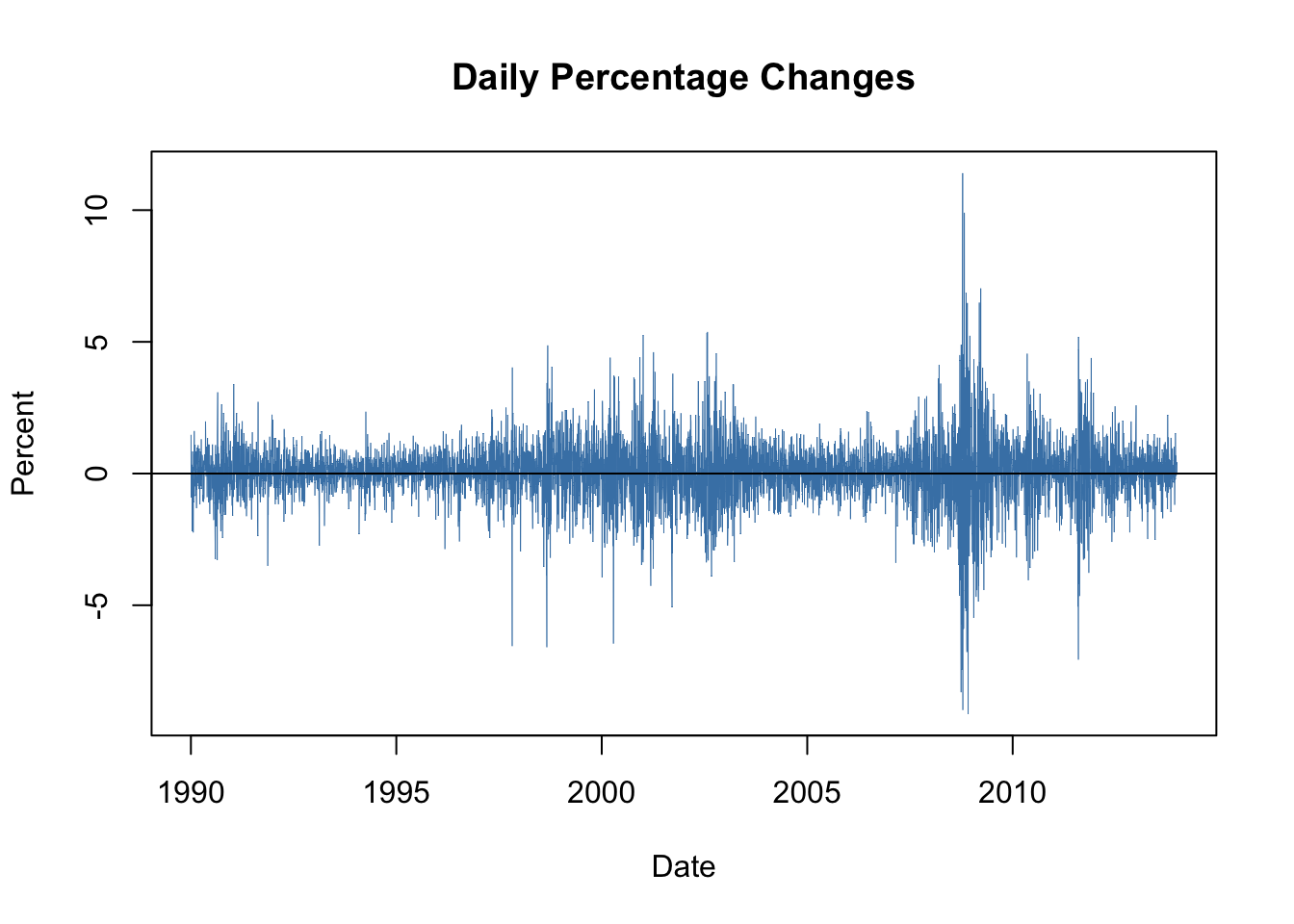

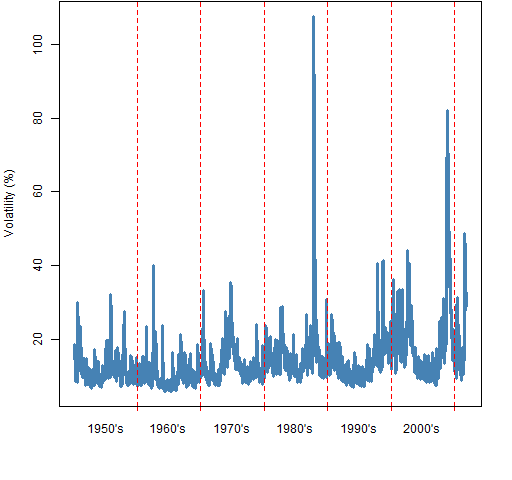

16.4 Volatility Clustering and Autoregressive Conditional Heteroskedasticity | Introduction to Econometrics with R

EViews10): How to Estimate Standard GARCH Models #garch #arch #volatility #clustering #archlm - YouTube

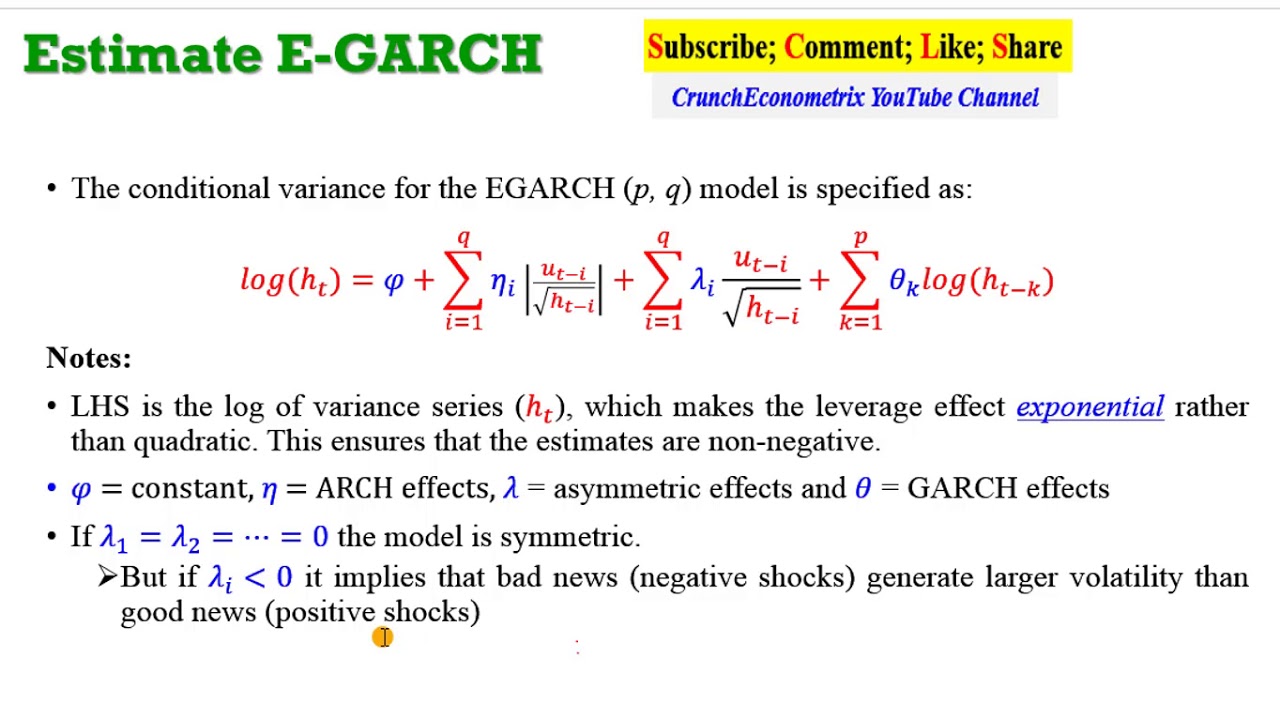

EViews10): How to Estimate Exponential GARCH Models #garchm #tgarch #egarch #igarch #cgarch #arch - YouTube

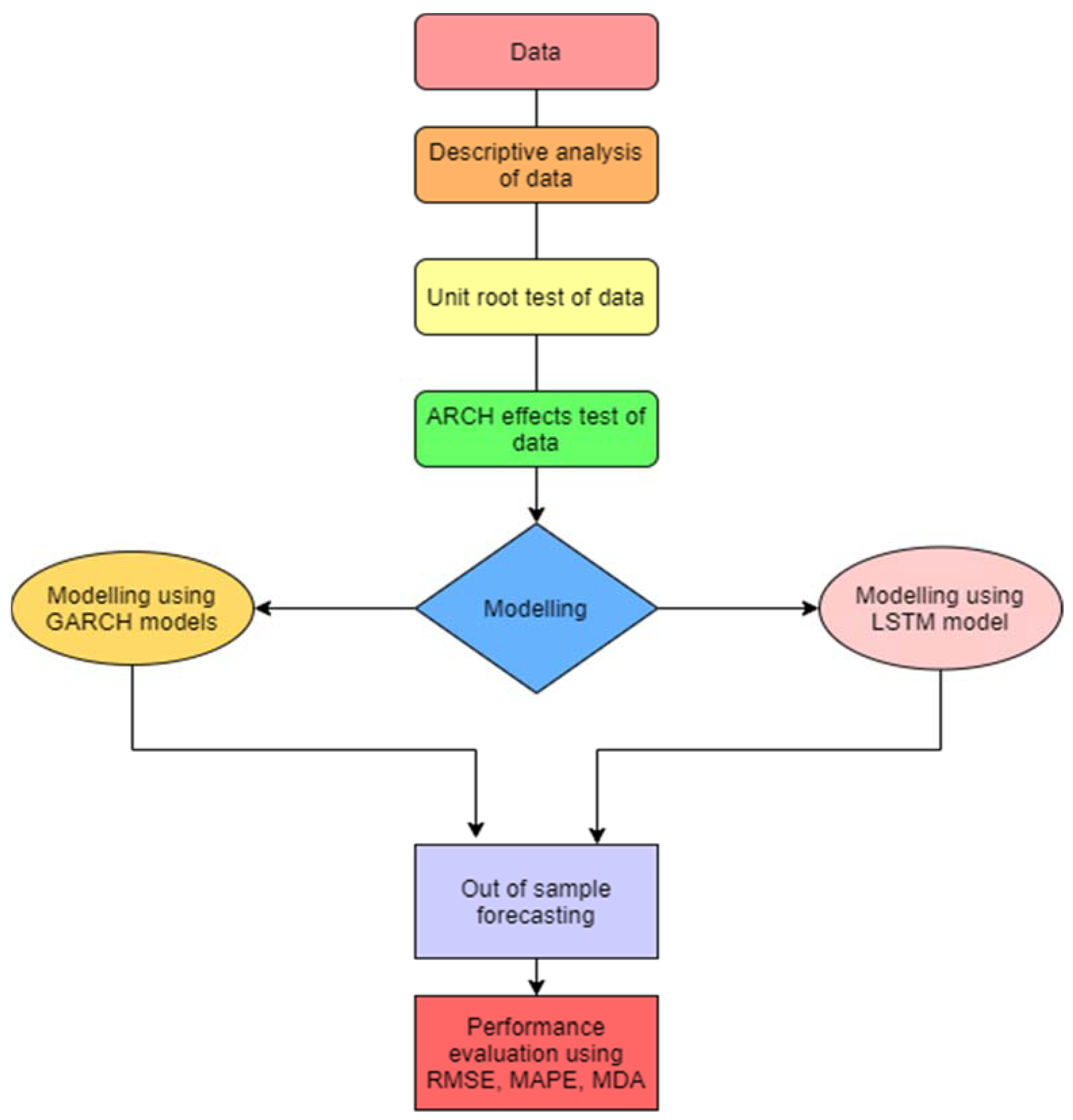

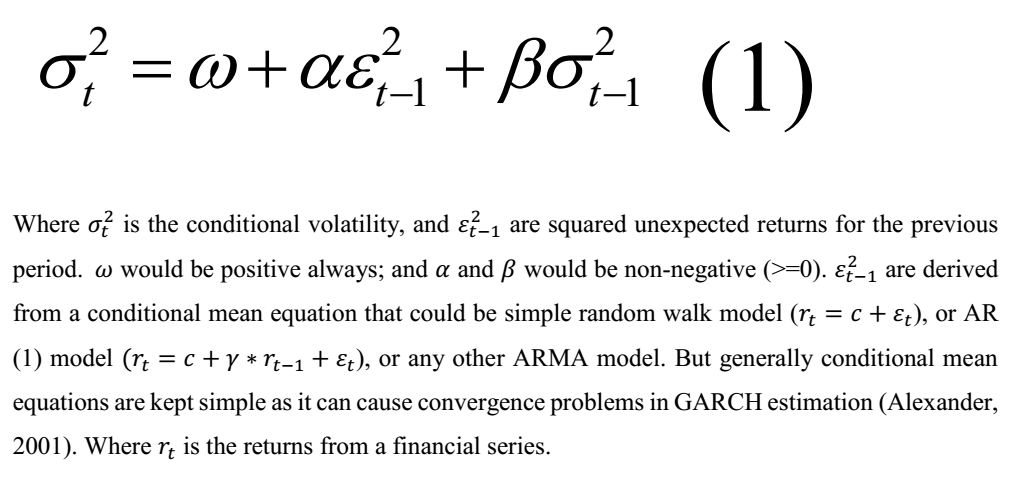

Economies | Free Full-Text | Modeling and Forecasting the Volatility of NIFTY 50 Using GARCH and RNN Models

How should I interpret the resulting coefficients in the conditional variance equation of an GJR-GARCH (1,1) model? | ResearchGate

A practical introduction to garch modeling | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

![PDF] Evaluating the Forecasting Performance of GARCH Models. Evidence from Romania | Semantic Scholar PDF] Evaluating the Forecasting Performance of GARCH Models. Evidence from Romania | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/19c5a7d01d961014be902983e7ac86cd35974bbc/2-Table1-1.png)

PDF] Evaluating the Forecasting Performance of GARCH Models. Evidence from Romania | Semantic Scholar

EViews10): How to Estimate Standard GARCH Models #garch #arch #volatility #clustering #archlm - YouTube

:max_bytes(150000):strip_icc()/GARCH-9d737ade97834e6a92ebeae3b5543f22.png)

![PDF] Forecasting volatility using GARCH models | Semantic Scholar PDF] Forecasting volatility using GARCH models | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/8286abb9bb8faad7f6c0de936390201d2789a82f/20-Table3.2-1.png)