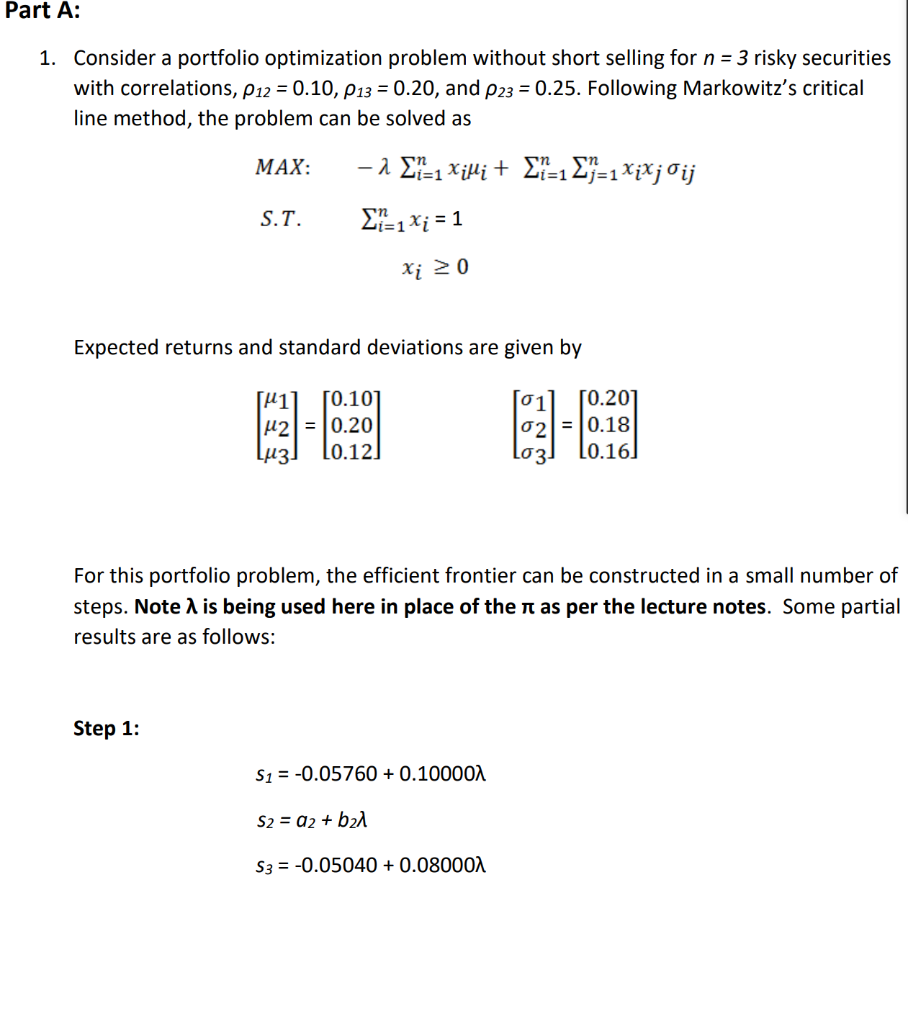

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

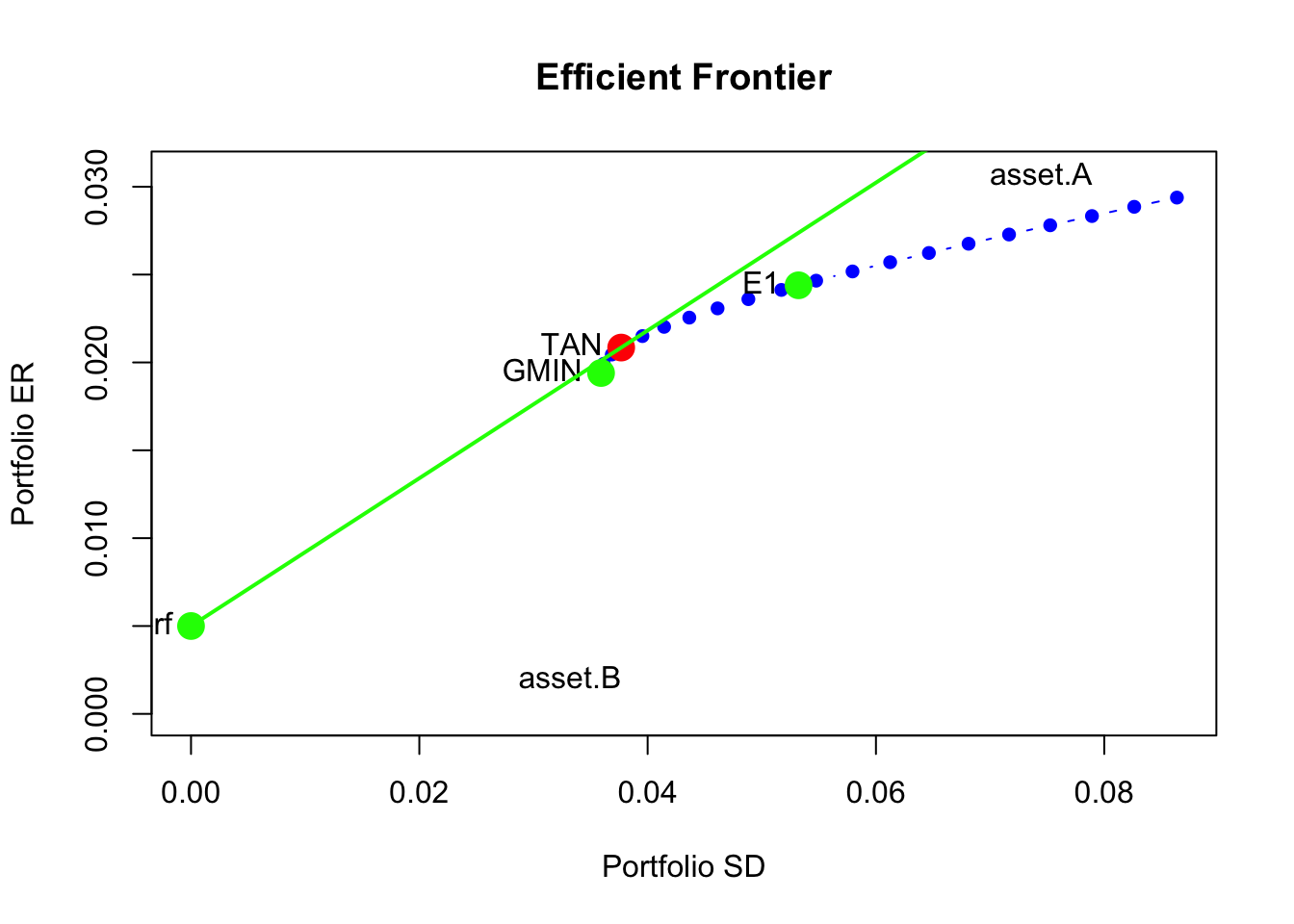

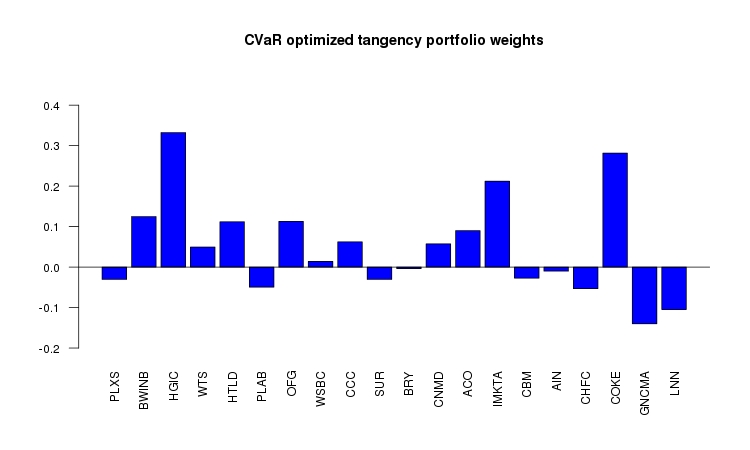

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

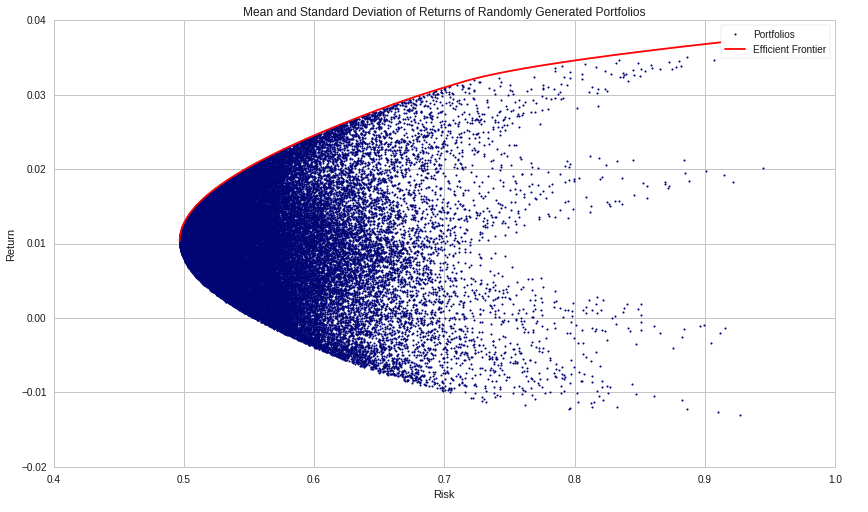

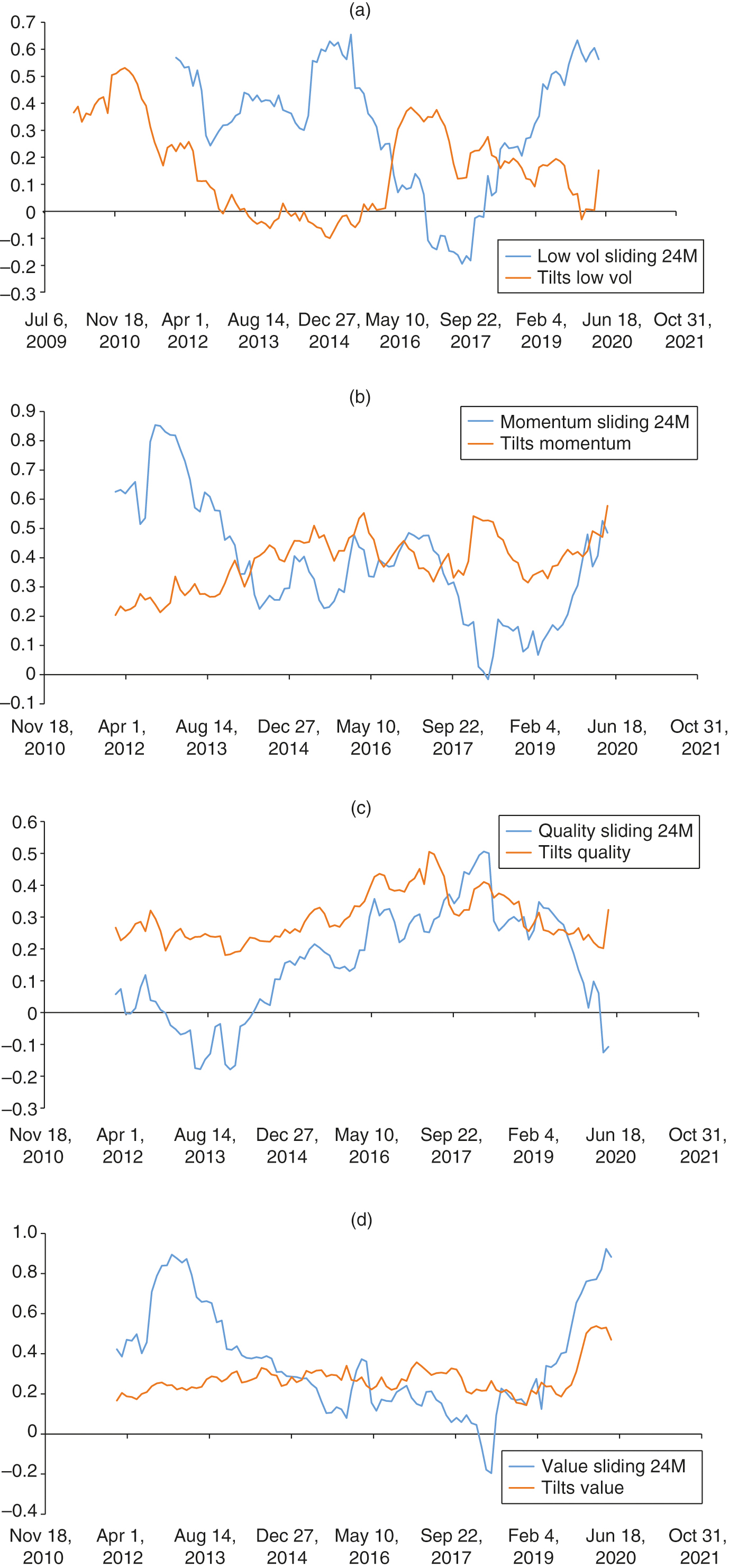

The impact of regulation-based constraints on portfolio selection: The Spanish case | Humanities and Social Sciences Communications

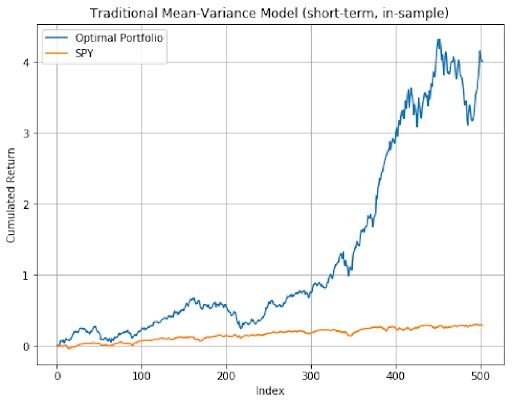

Applied Sciences | Free Full-Text | Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading

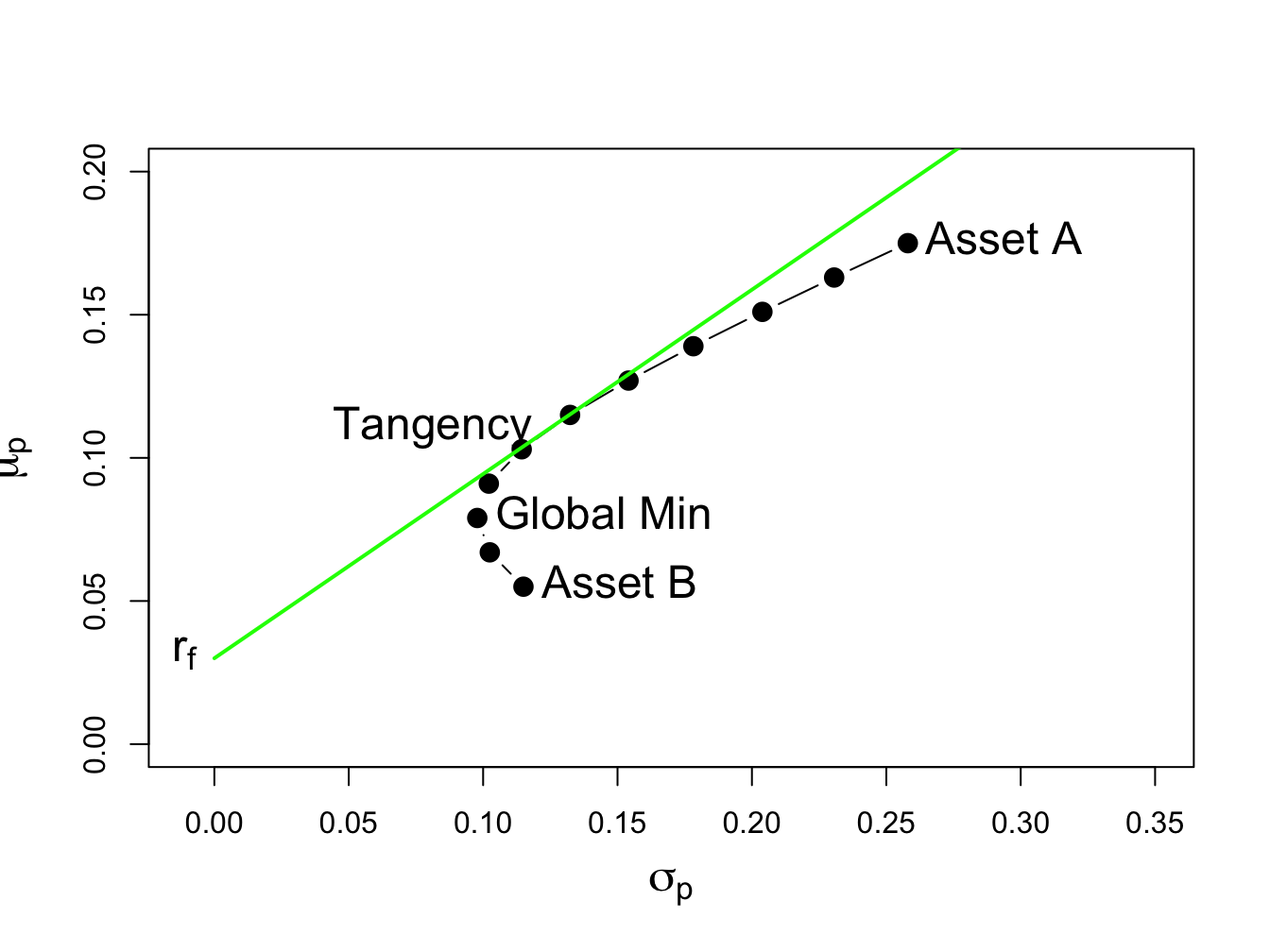

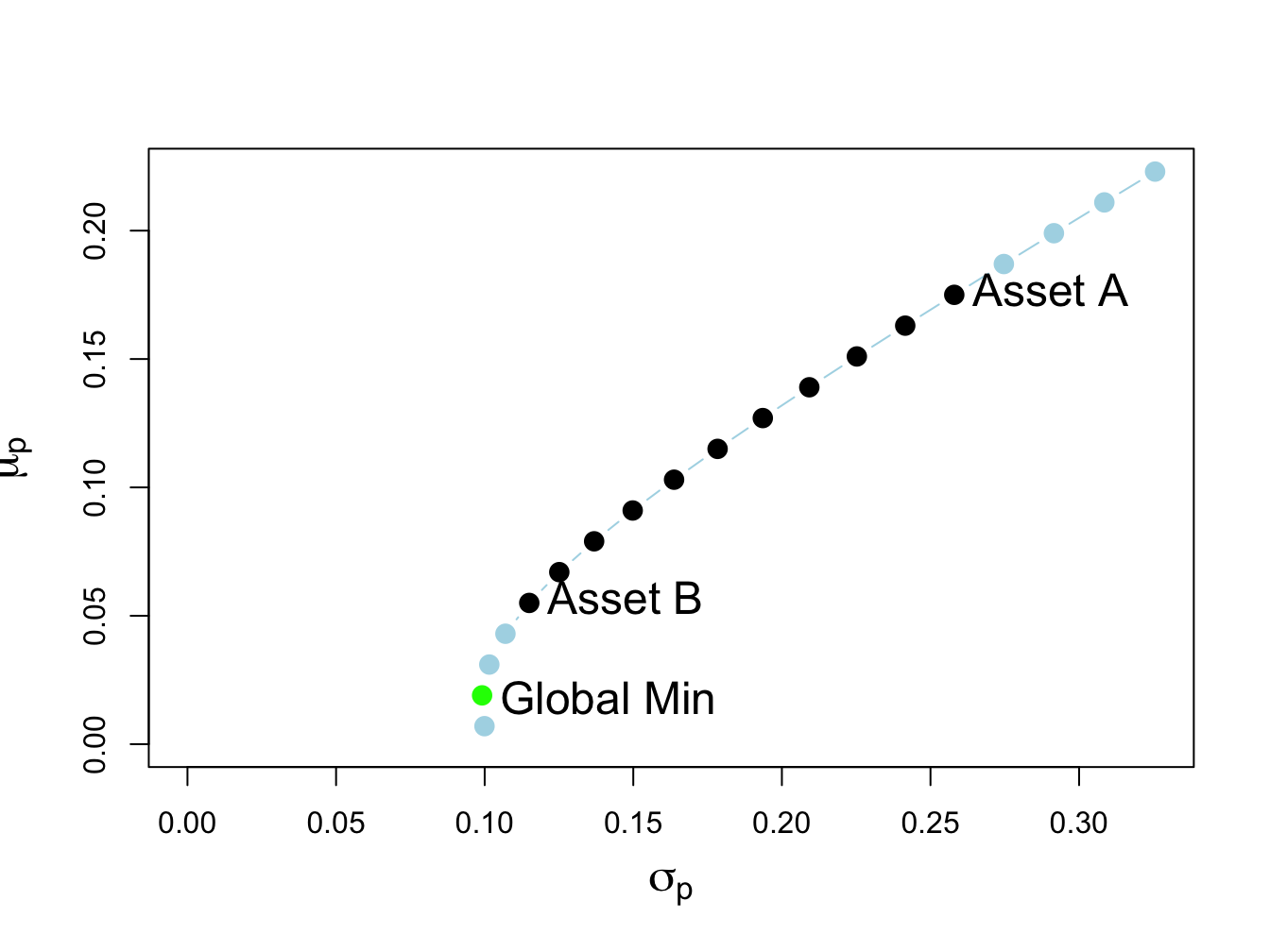

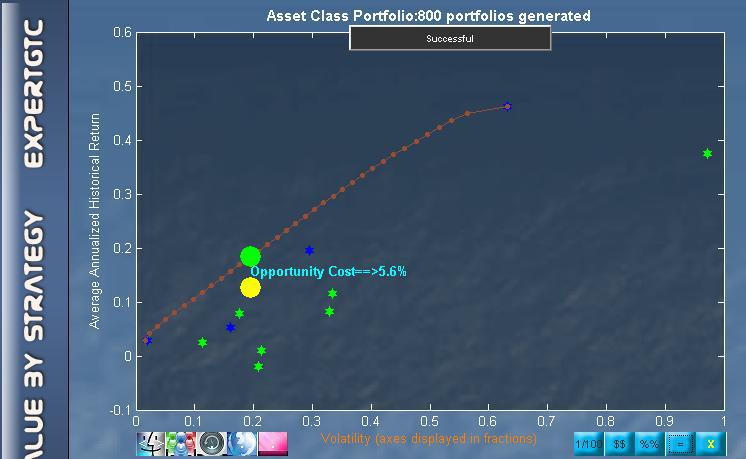

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

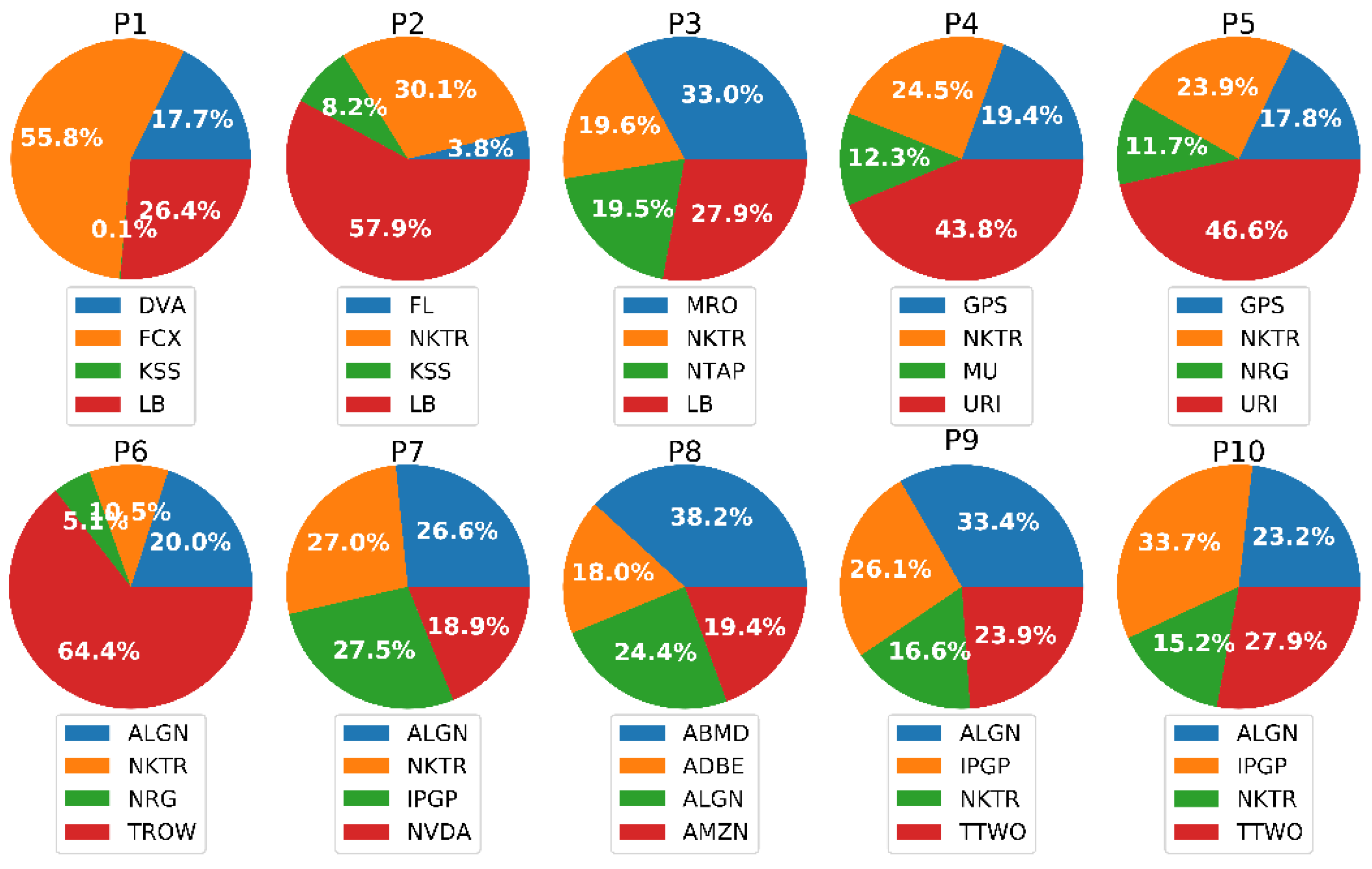

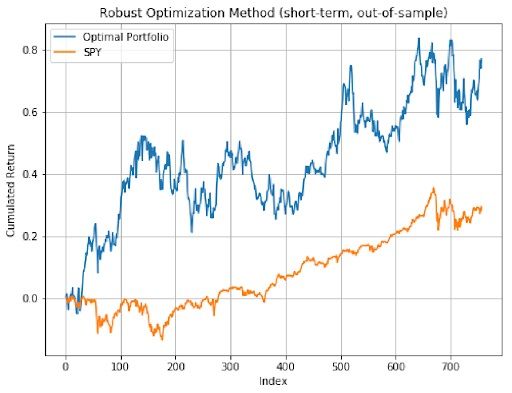

GitHub - georgemuriithi/investment-portfolio-optim: An investment portfolio of stocks is created using Long Short-Term Memory (LSTM) stock price prediction and optimized weights. The performance of this portfolio is better compared to an equally

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

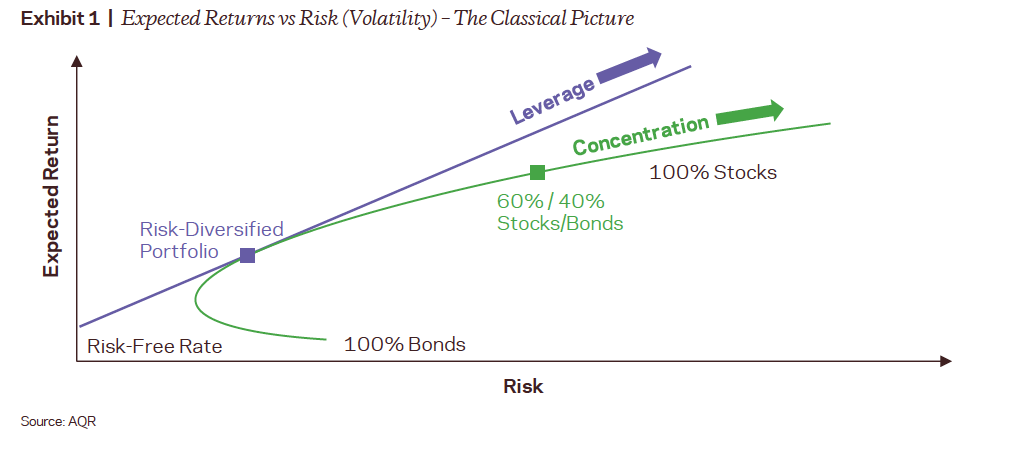

The Smart Money Prefers Long/Short Portfolios, But The Vast Majority Of AUM Is Long-Only | Seeking Alpha

:max_bytes(150000):strip_icc()/Modern-Portfolio-V2-9a0e2a7c92764f0cb194615eaedcdd76.jpg)